Over at the National Journal's Energy forum, my Breakthrough Institute colleague Alex Trembath and I have a new submission to their ongoing discussion asking "How Can Washington Green America's Economy?" Here's the full text...

Over at the National Journal's Energy forum, my Breakthrough Institute colleague Alex Trembath and I have a new submission to their ongoing discussion asking "How Can Washington Green America's Economy?" Here's the full text...

Before discussing the best way to green the economy, it’s important to note that the U.S. economy has been greening steadily over the past three years. Buoyed by the policies established and extended by the American Recovery and Reinvestment Act (ARRA), the largest federal investment in clean tech in American history, the clean energy industry has experienced precipitous growth, as documented by Mark Muro and colleagues at the Brookings Metro program in their recent "Sizing the Clean Economy" report.

Unfortunately, the path of progress may be coming to an end. Our research shows that over 70% of the federal policies and funding support for clean energy that has catalyzed the recent growth of the industry is expected to lapse in the next three years, or has already expired. And make no mistake—clean energy is an industry dependent on government subsidy: tax credits, depreciation and other subsidies compose one third or more of the total after-tax value of most solar, wind or other renewable energy projects, for example. So while ARRA provided a “down payment” on a green economy, as these public investments fade away, we are now more likely to witness a clean tech crash than a clean tech revolution.

As the current programs supporting clean energy, like the Production Tax Credit (PTC) and Section 1603 Treasury Grants, approach their expiration, there are a number of steps the federal government can and must take to avert an impending industry crash.

The first would be to get serious about the long-term energy innovation challenge. Until clean energy becomes cheap and cost competitive without subsidy, the pace of clean energy growth will remain constrained and the markets will face continual risk of industry busts if subsidy and policy support changes. We must treat energy innovation with the same priority we afford other national innovation quests, such as the Apollo or Manhattan Projects or the quest to cure cancer. We must invest far more -- eventually on the order of $15 billion annually -- and far more wisely -- restructuring America's energy innovation system and supporting effective new policy models such as the Advanced Research Projects Agency-Energy (ARPA-E), Energy Frontier Research Centers (EFRCs), and new public-private regional innovation consortia.

Second, Congress can establish a Clean Energy Deployment Administration (CEDA). CEDA would act as a public investment bank whose mission is to help leverage private-sector investment to bring emerging, innovative clean technologies to commercial maturity. CEDA would bridge the commercialization “Valley of Death” and provide a viable and predictable development path for technologies from the laboratory to grid-scale deployment. The Congressional Budget Office calculates that the agency would cost just $1.1 billion over the next four years. While leveraging billions more in private sector investment, the public bank would return profits from investments and financial products to the fund, making CEDA self-sustaining over time.

Another needed policy change is to reform the current clean energy deployment subsidy regime for maturing energy technologies, which today is comprised of a hodgepodge of tax credits like the PTC and the Investment Tax Credit, depreciation benefits and grants that primarily incentivize firms to deploy more of the same, current-generation technology. Instead, we need a smarter new deployment mechanism that is disciplined and designed to drive technology innovation to decrease the unsubsidized cost of clean energy so that it can be competitive without perpetual subsidy. Such a policy could augment a national renewable or clean energy standard (RES/CES) with a set of technology tiers based on technology maturity, which would provide the incentive for utilities to adopt and deploy clean energy technologies across a range of maturities, and demand continual cost reductions from technology firms over time. One way to augment this smart deployment policy would be with a small price on carbon, wires fee on electricity, or oil import fee, which instead of returning a dividend to consumers would generate dedicated revenues for a federal energy R&D fund to help support the continual innovation needed to get clean tech costs down to parity with fossil competitors.

The fate of many ARRA policies remains uncertain, and the unpredictable political machinations of the “supercongress” and ongoing deficit debate in Washington bring yet more volatility to the clean tech policy debate. Nobody expects a second down payment on the green economy on the scale of the last several years. But as current subsidy support runs out, Washington must support the industry by investing more and differently in clean energy innovation to maintain America’s position in the global clean tech race and avoid an ongoing cycle of clean tech boom-and-bust in the future.

Wednesday, August 17, 2011

National Journal: Surviving the Coming Clean Tech Crash

Wednesday, October 27, 2010

Should We Borrow from the Future to Pay for Clean Energy Innovation Today?

Originally posted at the Breakthrough Institute

Originally posted at the Breakthrough Institute

Here's an interesting argument from our friends across the pond at the UK-focused Political Climate blog, making the case that despite rising deficit concerns and austerity measures in the UK and elsewhere, borrowing from the future may still actually be an appropriate way to pay for clean energy innovation today:

Against this background, it may sound mad to argue for more public borrowing in order to pay for investments in low carbon technologies and infrastructure, but that is what I am going to do in this post.Political Climate's team makes the point that long-term government financing rather than bank loans is the right way to do this kind of borrowing, with fifty-year terms for government bonds that can be paid back over time by (now richer) future generations.

Let's start with the rationale. ... The starting point is that in advanced economies successive generations tend to get better off over time. For example, at the depths of the 1930s depression Keynes observed that despite the general gloom, he was confident that 100 years in the future, people might be eight times better off in real terms. And indeed average GDP per capita in the UK is now already about 5 times what it was in the 1930s. By extension, we would normally expect future generations to be better off than us in GDP terms.

... [Furthermore, if] we in this generation mitigate climate change, we will allow future generations to have a higher standard of living than they would have if we did nothing. We are very slowly beginning to do this, with policies being introduced to encourage us to invest less in conventional capital (e.g. fossil fuel power stations) and more in investments that effectively maintain natural capital (like renewable energy).

At the moment we are paying for these more expensive investments through reduced consumption, in the form of higher energy bills. If instead we were to borrow a certain amount of money from future generations (who will have to repay through their taxes) and use this money to pay the extra cost of renewables, carbon capture and storage and so on, then the theory says it should be possible to make both our generation and future generations better off. ...

Here in the United States, we financed much of the electrification, irrigation, and development of the American West (and the Tennessee Valley in the southeast) through precisely this kind of long-term government-backed borrowing. The hydroelectric dams and reservoirs, power lines and irrigation systems, clean and affordable energy, productive farms, and burgeoning new cities that resulted from these debt-financed investments paid off many times over, making generations living today far better off than if this debt hadn't been incurred.

A similar case could be made for innovation investments as well, since the benefits of new, innovative products and technologies -- be it better clean energy technologies or pharmaceutical drugs -- will accrue most to those living in future times, who can harvest the rewards of today's investment in research and innovation.

This also brings to mind the old idea of a capital budget for nation governments...

Thought provoking piece at least. What do you think, dear reader? Despite rising national debts, would national governments be wise to borrow today to fund investments in infrastructure, clean energy, and innovation to be enjoyed by -- and paid back by -- a richer, more well-off generation tomorrow? Read more!

Friday, September 17, 2010

Brooks: Anti-government Ideology Threatens American Greatness

By Devon Swezey and Jesse Jenkins, originally at the Breakthrough Institute

By Devon Swezey and Jesse Jenkins, originally at the Breakthrough Institute

It is fashionable these days to paint the government as a useless yet ravenous institution, the expansion of which will turn America into a third world country - or, worse yet, France.

Even the Economist, a respected, moderate publication, has recently taken to framing the government as a hideous Leviathan consuming private business, and everything else in its path.

But according to a new column by conservative commentator David Brooks, the hysterical, anti-government ideology that has taken root within even mainstream corners of the Republican Party is driven by an "oversimplified version of American history, with dangerous implications."

Writing in the New York Times, Brooks reminds his fellow conservatives that the history of American innovation and economic strength is one of "limited but energetic governments that used aggressive federal power to promote growth and social mobility."

"George Washington used industrial policy, trade policy and federal research dollars to build a manufacturing economy alongside the agricultural one. The Whig Party used federal dollars to promote a development project called the American System.Certainly, this country's innovative private businesses and intrepid entrepreneurs have been central to making America the world's leading economy. But time and again, America's entrepreneurs have succeeded with the full and active support of the federal government, without which, things may have turned out very differently.

Abraham Lincoln supported state-sponsored banks to encourage development, lavish infrastructure projects, increased spending on public education. Franklin Roosevelt provided basic security so people were freer to move and dare. The Republican sponsors of welfare reform increased regulations and government spending -- demanding work in exchange for dollars."

As the Breakthrough Institute documented in our 2009 report, "Case Studies in American Innovation," the story of American innovation is one of enduring partnership between the public and private sector, where smart public investments have catalyzed entrepreneurialism and innovation and paved the way for so many of the great American technological and economic success stories of the 20th century.

Time and again, public-private partnerships have driven the development of whole new industries, and created the conditions for leading private sector companies to thrive. Without the public sector as both an initial funder and demanding customer, the vibrant industries built around great American innovations in communications, aerospace, semiconductors, computing, biotechnology and many more may have sprouted up elsewhere, or not at all.

Giving credit where credit is due, former Microsoft Chairman Bill Gates, one of the nation's greatest entrepreneurs and business leaders, recently noted that early government investment in information technology was central to the success of Microsoft and so much of the IT revolution that propelled Americas economy in the later years of the 20th century:

"The Internet and the microprocessor, which were very fundamental to Microsoft being able to take the magic of software and having the PC explode, were among many of the elements that came through government research and development."Indeed, the catalytic investments of the federal government have been central to the success of countless leading American firms, including HP, Apple, Genentech, Boeing, and Dow Chemical, along with hundreds of the small businesses and entrepreneurs that are the core of America's economic strength.

According to R&D Magazine, a quarter of the top 100 innovations in America each year consistently come from small businesses that are funded by one federal program alone--the Small Business Innovation Research (SBIR) program.

Many conservatives, and indeed many liberals and environmentalists as well, have forgotten this history, and believe that the private sector is most innovative when the government is most absent.

Yet, as Brooks reminds us, the greatest American Presidents, from Washington to Lincoln, to Roosevelt, didn't build their philosophies or their policies around small government or big government, but smart government:

"Government is a means, not an end. They built their philosophy on making America virtuous, dynamic and great. They supported government action when it furthered those ends and opposed it when it didn't."This "long, mainstream American tradition" is by the reflexive anti-government ideology of the surging Tea Party, now fighting for the soul of today's Republican Party.

For America to remain a great nation in the 21st century, smart government policies and investments will be essential. Whether or not those pivotal investments are made may hinge on the ability of conservatives and liberals alike to overcome this collective amnesia about what made this country great in the first place.

See also: Read more!

Labels:

economy,

Government,

Republican Party

Tuesday, August 24, 2010

White House Report: Stimulus Driving Clean Energy Innovation, Manufacturing, Markets – But What Comes Next?

With global competition mounting and Recovery Act momentum poised to fade, can the Obama Administration secure a lasting clean energy legacy?

With global competition mounting and Recovery Act momentum poised to fade, can the Obama Administration secure a lasting clean energy legacy?

By Jesse Jenkins and Devon Swezey

The American Recovery and Reinvestment Act has funded breakthrough innovation and new growth industries that are driving down the cost of clean energy and building the foundation for competitive 21st century U.S. industries, according to a new White House report released today on the impacts of the U.S. stimulus bill.

The report, “The Recovery Act: Transforming the American Economy Through Innovation,” is notable for highlighting the multifaceted and relatively comprehensive clean economy strategy now underway with stimulus investments, and for the Administration’s welcome focus on making clean energy cheap.

Yet while the White House report highlights the considerable clean energy momentum established by the Recovery Act, it also inadvertently raises the specter of an impending clean tech funding cliff which risks sending U.S. clean energy industries into deep freeze as stimulus funds begin to expire over the coming months.

To achieve the White House’s long-term objectives – driving down the costs of emerging clean energy technologies such as solar power and advanced batteries and building globally competitive American clean energy industries – will require a long-term, comprehensive clean economy strategy and sustained investments in innovation, advanced manufacturing, and competitive market deployment.

The White House report correctly frames the overriding goal of clean energy investment around making clean energy cheap in real, unsubsidized terms. For solar energy, according to the report, the near-term goal is for solar electricity to be competitive with retail electricity rates, with a long-term goal to compete with central fossil fuel power plants. As the Breakthrough Institute has consistently argued, taking clean energy alternatives to scale and building globally competitive clean energy industries will ultimately depend on such improvements in cost and performance.

Cost reductions and performance improvements in solar technology, advanced batteries, and electric-drive vehicles will be driven by a confluence of factors, according to the report, including direct public support for energy innovation, manufacturing and deployment, and by strengthening the linkages across all three areas.

The White House report notes that the Recovery Act is accelerating solar energy innovation by providing funding for greater solar energy deployment, manufacturing and scale-up, and catalyzing needed technological breakthroughs to create novel and more efficient technologies. All told, these measures may help reduce to cost of solar power by 50% in coming years, according to White House estimates, while building domestic manufacturing capacity and investing in next-generation solar breakthroughs that could form the basis of entire new U.S. industries.

Similarly, stimulus investments have helped transform the United States from a bit player in international advanced battery markets to a global competitor with an estimated 20 percent of worldwide manufacturing capacity online by 2012, all while potentially driving down the cost of electric vehicle batteries by up to 70%. The key to success, the White House says, has been “investments across the innovation chain – from retooling current auto factories to new manufacturing and commercial deployment to research and development of electric drives and batteries.”

This multifaceted focus on innovation, manufacturing, and markets, bears a striking resemblance to the comprehensive clean economy strategy the Breakthrough Institute has spent much of the past two years advocating through an ongoing series of reports, policy recommendations, Congressional testimony, and writings.

It is notable, however, how distinct such a strategy is from the dominant cap and trade debate that has consumed essentially the entire Congressional calendar since passage of the Recovery Act in February 2009. The nearly complete focus of the subsequent Congressional energy and climate debate on the primacy of carbon pricing may have ultimately prevented meaningful debate on how to optimize and extend the critical, comprehensive clean energy investments begun under to stimulus and enact a long-term investment strategy to strengthen clean energy competitiveness.

Indeed, while the stimulus was supposed to be a “down payment” on a new clean energy economy, the Congressional cap and trade bills—which would have invested little in clean energy technology—left the country likely to default on long-term clean energy promises.

Meanwhile, our economic competitors are not making the same mistakes we are, and are continuing to publicly invest in their domestic energy innovation systems in a bid to capture the increasing economic rewards inherent to the burgeoning clean energy industry.

China is set to unveil a massive $740 billion, 10-year package of direct investments to secure their economic leadership in emerging clean energy industries. China already dominates global market share for electric batters, wind turbines, and solar panels, and is rapidly boosting its capacity to innovate and produce next-generation clean energy technologies. Japan, South Korea, Germany, Spain, Denmark and a host of other international competitors are also fast at work building domestic clean energy industries with a multifaceted focus on innovation, manufacturing, and markets.

Facing such intense global competition, and with Recovery Act funds poised to expire soon, sending U.S. clean energy markets off a clean tech funding cliff, the U.S. is in dire need of a long-term clean energy investment strategy to regain economic and technological leadership in this new growth sector.

The substantial and successful impact of the public investments in the U.S. stimulus bill point to a way forward, but unless rapidly followed by a long-term, sustained investment strategy, the Obama Administration’s clean energy legacy may wind up tarnished by the continued erosion of U.S. clean energy competitiveness.

Jesse Jenkins is Director of Energy and Climate Policy and Devon Swezey is Project Director at the Breakthrough Institute. Both are co-authors of “Rising Tigers, Sleeping Giant” a comprehensive report on global clean tech competitiveness, and “Strengthening Clean Energy Competitiveness,” a set of Congressional policy recommendations.

Wednesday, July 07, 2010

Forget About the Deficit - Invest in the Green Economy Now!

By Jerome E. Roos, Breakthrough Fellow.

By Jerome E. Roos, Breakthrough Fellow.

This is a guest post from the Breakthrough Generation blog. Breakthrough Generation is the young leaders' initiative of the Breakthrough Institute, a public policy think tank. Founded in 2007, Breakthrough Generation has fostered the development of young thought leaders capable of fully grappling with the scale and complexity of today's greatest challenges and advancing large-scale solutions over the near and long term. To read more writings from this year's 2010 Breakthrough Fellows, head to http://breakthroughgen.org

Europe has lost its mind. Just two years after the financial crisis pushed the global economy to the brink of collapse, we appear to have forgotten all historical lessons about the importance of stimulating aggregate demand in the face of an economic slowdown. All over the continent, deficit hawks have built their nests in the ivory towers of government, trapping the world's largest economy back into the shackles of the neoliberal straitjacket.

If we are to truly deal with the two overwhelming crises of our time - climate change and economic meltdown - we need to realize where these crises overlap and where their solutions could reinforce one another. History teaches us that the world did not emerge from the Great Depression until it mobilized for World War II and built the War Economy. Today, we need mobilization on a similar scale to build a Green Economy and avert the worst consequences of climate change. In the process, we can create millions of jobs and forestall a global depression.

As the Greek debt crisis has recently illustrated, global speculators still hold just as much sway over currency and bond markets as investment bankers until recently held over financial markets. The musical chairs of global capital nearly forced the Eurozone to its knees earlier this year, triggering a backlash of primordial fear among European populations that economic apocalypse was imminent.

Ironically, nationalists, conservatives and free-market fundamentalists - that's right, the folks responsible for causing the crisis in the first place! - were amply rewarded by utterly confused electorates for their misleadingly simple solution to our economic ills: deficit reduction at a pace faster than advocated by even the most hardcore hawks in the U.S.

While it seemed to some that Thatcher's soul had died with the collapse of Lehman Brothers back in 2008, her macro-economic ghost has apparently come back to haunt our continent with a vengeance in 2010. "Balance the budget!" appears to be the most intellectually profound phrase coming out of the watering mouths of self-proclaimed economists like art-history student David Cameron of the UK, history student Mark Rutte of the Netherlands, and physics student Angela Merkel of Germany.

Now that our world is gradually coming undone at the seams, such executive incompetence is no longer just a source of amusement; it has become a threat to our collective well-being. Is this really the most creative solution we can come up with to solve the crises we are facing? With global temperatures rising higher every year and unemployment reaching levels not seen since the 1930s, is this really the mantra that will save global capitalism from itself?

Leading economists like Columbia's Nobel Laureate Joe Stiglitz, Princeton's Nobel Laureate Paul Krugman, and Harvard's Dani Rodrik strongly disagree. These experts argue that we need growth before we can balance our budgets, and in order to revive growth, we need to first stimulate aggregate demand by making serious public investments in infrastructure and industry.

In an op-ed piece warning us of the oncoming Third Depression, Krugman argues that:... this [coming] depression will be primarily a failure of policy. Around the world -- most recently at last weekend's deeply discouraging G-20 meeting -- governments are obsessing about inflation when the real threat is deflation, preaching the need for belt-tightening when the real problem is inadequate spending.

In my home country of the Netherlands, we seem to have grown more terrified of short-term debt than long-term inundation as a result of climate change. But Joseph Stiglitz already pointed out several months ago that the conservative narrative on the problem of short-term debt is utterly misleading:Faster growth and returns on public investment yield higher tax revenues, and a 5 to 6% return is more than enough to offset temporary increases in the national debt. A social cost-benefit analysis (taking into account impacts other than on the budget) makes such expenditures, even when debt-financed, even more attractive.

Dani Rodrik agrees, arguing that:... Europe needs a short-term growth strategy to supplement its financial-support package and its plans for fiscal consolidation.

Such a short-term growth strategy should revolve around a visionary project for public investment in green infrastructure, like the replacement of our aging micro-grids with a much more efficient continental super-grid, the wholesale retrofitting of public buildings, the creation of a standardized plug-in recharging infrastructure, and more public-private collaborations on massive solar voltaic and wind projects. Such short-term public investments have the potential to create millions of jobs and kick-start the transformation to the Green Economy before the longer-term investments in R&D of breakthrough technologies kick in.

It is time for Europe's hopelessly childish leaders to stop being bossed around by global speculators and start building the economy that will lead our continent into a new era. To actually get there, we first have to stop worrying about the imaginary climate for investors and start mobilizing to protect the physical climate for our people. This way we might just kill two birds with one stone.

Monday, May 24, 2010

Entrepreneurs Wanted: Must be willing to think big to transform energy for the poor

A guest post by Hugh Whalan

A guest post by Hugh Whalan

When Apple transformed the music industry with the iPod and iTunes, and when Google revolutionized internet search capabilities, it was a win for everyone – consumers got better products and the companies providing them became rich.

There are billions of energy-poor consumers in desperate need of exactly this kind of industry transformation. The sheer size and growth potential of the market has the potential to create the next generation of huge energy companies – as large as BP, Shell and Exxon – which are focused on providing small scale energy solutions to the billions for whom this is the best solution.

The opportunity for the entrepreneurs who will build the next generation of energy mega-companies can be summed up with three simple points:

- Those at the Bottom of the Pyramid (BOP), people earning $1-$6 dollars a day, already spend a lot on energy. More than $US433 billion each year according to the World Resources Institute (WRI). WRI estimates energy is the second largest market in the BOP markets –bigger than the transport, health, ICT and water sectors combined.

- Studies show that the average BOP consumer would use more energy if they could afford to. This means that as the poor come out of poverty and as the price of each unit of energy drops, the market will continue to grow.

- The energy resources currently meeting BOP consumer demand are overwhelmingly archaic and inefficient (e.g. kerosene, dung, firewood, and charcoal).

I hope they all become billionaires because the more entrepreneurs who see the pot of gold at the end of this rainbow, the better. More entrepreneurial attention will result in more innovation and competition, which leads to better service and products for paying consumers. For the billions relying on kerosene, firewood, and charcoal, I guarantee you, this cannot come too quickly.

Hugh Whalan is the CEO and co-founder of Energy in Common, a non-profit allowing individuals to make micro-loans to fund green energy entrepreneurs in developing countries. Read more!

Wednesday, May 05, 2010

A Vision to End Energy Poverty

By Hugh Whalan – Guest Blogger

What is energy poverty?

Energy forms the foundation of almost every economic development outcome – powering education in classrooms, refrigerating vaccines, pumping clean water, allowing for study or work after dark. Everything relies on energy. Think about what you do in the morning, and how many times you flick a switch, or press a button and expect something to work. We do this dozens of times a day, without thinking about it.

For more than 2.4 billion people, that kind of access to energy is nothing but a dream. These people spend hours each day collecting firewood, and the fuels they do have access to - like dung, charcoal and kerosene – are either polluting or expensive, or both. This is energy poverty. The energy poor spend more on energy, and get less for it.  Graphic source: World Health Organization

Graphic source: World Health Organization

Indoor air pollution caused by these fuels kills more people each year than malaria; the trees cut down for firewood lead to deforestation; and the greenhouse gases released by burning these fuels contribute to climate change.

Why is energy poverty the most important development need of today?

Energy poverty is only starting to receive the kind of attention it warrants. The International Energy Agency recently stated that the UN goal of halving world poverty by 2015 would only be met if energy was expanded to a further 700 million people.  Graphic source: PracticalAction.org

Graphic source: PracticalAction.org

I think the challenge, and the opportunity for energy is bigger than that. We live in a world projected to hit 9 billion people- with most of this population being born into poverty. Along with this population comes greenhouse gas emissions - 95% of the increases in greenhouse gas emissions over the next three decades are projected to come from the developing world. These greenhouse gases will drive climate change, which is expected to disproportionately affect the poor and hinder efforts to alleviate poverty. Through this lens, climate change is intimately connected to poverty.

It’s a vicious cycle, where energy poverty creates a reliance on polluting fuels which not only penalize the poor, but also contribute to climate change which further entrenches poverty.  Aerial imagery of the Haiti-Dominican Republic border shows the clear toll of deforestation fueled by energy poverty. (Image source)

Aerial imagery of the Haiti-Dominican Republic border shows the clear toll of deforestation fueled by energy poverty. (Image source)

By addressing energy poverty effectively, there is a good chance we can alleviate poverty, reduce greenhouse gas emissions, and improve access to education, health services, clean water, and other development outcomes.

How do we address energy poverty effectively?

I believe the answer lies in green energy and the free market.

The fact that there are 2.4 billion people without access to modern energy – living with virtually the same energy resources as our cavemen ancestors 125,000 years ago - is something I see as one of the largest market failures in the world today. It is a market failure because these people are paying customers receiving substandard quality and service.

A vision for addressing energy poverty.

Enter the 21st century green energy entrepreneur. This green energy entrepreneur sells energy products such as LED lamps, solar home systems, clean burning cook stoves, solar powered drip irrigation systems and biogas digesters. These systems cost more upfront than traditional energy resources like kerosene and charcoal, but a fraction of the cost over a longer period of time. All of these systems pay for themselves through energy savings and increased revenue generation in a matter of months, not years.

To make these systems affordable to everyone, the green energy entrepreneur works with microfinance institutions which act as bankers to the poor. Similar to the way that we in the West often would not be able to afford a car without a car loan, or a house without a mortgage, these microfinance institutions provide loans for these green energy systems.

All of a sudden, even the poorest, those earning $1 -6 a day, are able to purchase green energy in a way that accommodates their subsistence income patterns. Within 10 years, market failure is well on its way to being corrected, and green energy entrepreneurs are creatively setting about reaching those parts of the population not yet reached. More than a billion people have received access to some form of modern energy and green energy businesses form one of the largest industries in the developing world, only smaller in size than agriculture. It becomes standard to see green energy in even the most remote and poor households.

A result of this shift to green energy is that developing economies spend far less on fossil fuel based resources, and widespread access to energy means children can study after dark, businesses have longer opening hours, indoor air pollution is no longer a major killer, women waste far less time collecting firewood, and clean water is commonplace. A response to poverty becomes one of the most effective forms of greenhouse gas mitigation in history.

One step at a time.

Energy in Common (EIC) is a social enterprise I launched with co-founder Scott Tudman with the aim of allowing individuals to participate in correcting this market failure. We allow individuals to provide tiny green loans to the poor. As a result of our lenders, dressmakers, bakers, restaurant owners, and masons have safe, affordable, reliable access to modern energy – helping them to alleviate poverty and reduce greenhouse gas emissions. You can get started with a loan as little as $25.

Once a loan has been repaid to you, our team of people at EIC analyze the carbon data over the period of your loan and add up the amount of emission reductions created. These emission reductions are then sold to lenders (like you) as carbon offsets, which means you can buy the very carbon offsets that you helped to create. This allows you to reduce your carbon footprint too. That tax-deductible purchase then goes straight back into finding and helping even more entrepreneurs – and so the cycle begins again.

We aim to expand green energy access to over 15 million people within 5 years. In the process, we intend to bring resources and attention to the problem of energy poverty. You can find our website at www.energyincommon.org and you can lend at www.energyincommon.org/lend Guinean students study under the lights of the Conakry airport parking lot in June. (Image source: Rebecca Blackwell/The Associated Press, via DotEarth)

Guinean students study under the lights of the Conakry airport parking lot in June. (Image source: Rebecca Blackwell/The Associated Press, via DotEarth)

See also: More posts on 'energy poverty' from www.WattHead.org

Wednesday, March 10, 2010

Think You Know What a 'Green Job' Is? Think Again

Dr. Kelly spoke to an audience of Stanford University students Monday about the steps necessary to educate "the Energy Generation," warning that it will take a generation of the nation's best and brightest, working in dozens of diverse fields, to truly build a clean and prosperous American economy:

So what is a green job? Well green jobs are architects and engineers that build buildings, design buildings that operate at extremely low energy use. They are people that design, manufacture, and install devices in buildings ranging from high-tech windows to lighting to sensors and controls and electronics. It means looking at radically new industrial processes which simply replace previous kinds of industrial manufacturing with sophisticated bionumetics and nanotech approaches, to cutting down the material intensity and energy intensity of production, this is the kind of thing you need to do to stay competitive in the modern world."The bad news," Dr. Kelly said, is that America's competitors in Asia and Europe are surging ahead to develop competitive clean energy industries and investing in a highly-trained and technically competent workforce:

If you look at what the nation's transportation system is going to look like, Henry Ford looks like he's toast, it's going to be replaced with an entirely new generation of either extremely high efficiency fuel powered vehicles, electric vehicles, perhaps even hydrogen fuel cells - the people that make and maintain these are going to be operating in a different world that's an enormously sophisticated operation.

If you're looking at where power comes from, of course you have the entire range of science and engineering involved, you mentioned we're relying on geologists to tell us how to get geothermal energy, getting very sophisticate semiconductor manufacturers involved in the production of solar cells and CSP, if you look at biologically based fuels and materials, some of the most sophisticated biological processing techniques.

So this is an enormous range of skills, but apart from the technical skills you also need people who really understand the economics of finance... behavioral economics, people who understand policy, all of these qualify as green jobs and it touches I think almost every academic discipline.

The good news is that if we do this right we're generating a lot of new interesting jobs, not just for sophisticated designers but for people who are manufacturing and operating these.

"If you're looking at how the U.S. fairs competitively, we have far from the most highly trained workforce. In fact we're the only country in the top 20 OECD countries where... the average high school graduation rate is going down. We're static in university degrees and other countries are bypassing us, and they're getting degrees increasingly in the sophisticated subjects we need to move forward, both in energy and rebuilding our economy.While attention has been paid in recent years to funding new training programs for 'green collar' technicians, building trades, and manufacturing positions, the federal government has only just begun to put resources towards training and empowering the wide variety of cutting-edge innovators, engineers, and entrepreneurs needed to stay competitive in the 21st century clean energy race.

So we're facing this tremendous dilemma, where we have these opportunities to rebuild the economy around sophisticated technology that's clean, but the ability to turn out people who are able to actually take advantage of these opportunities is declining. It's something we're incredibly concerned about.

"The kind of things that you need to do make an economy that is clean and reducing its fossil fuel consumption is precisely the same thing you need to do to make the economy productive and competitive internationally, which means constantly transforming itself around new technology," Dr. Kelly said. "If you look at the kind of technologies we’re talking about, it goes touch virtually every part of the economy."

With Asian and European competitors pulling farther and farther ahead in competitive clean technology sectors, the economic stakes of these investments are high.

"There's little doubt we're in a race for our lives to maintain our productivity and competitive edge to keep high tech manufacturing here in the U.S." Dr. Kelly declared.

In 2007, Congress passed the Green Jobs Act which authorized $125 million in annual funding to develop training programs for workers in a variety of renewable energy and energy efficiency industries. The program was first funded with a $500 million chunk of the American Recovery and Reinvestment Act (the stimulus bill), and further funds were allocated in the climate bills now struggling to secure passage in Congress.

While the Green Jobs Act has advanced technical training programs at the nation's community colleges and technical schools, funding to inspire and empower students at four-year institutions to enter a wide range of careers crucial to competition in the clean energy sector has languished in Congress.

In 2009, President Obama's FY2010 budget included a new Department of Energy and National Science Foundation-run program called RE-ENERGYSE, the nation's first program aimed at strengthening America's position in clean energy education. Despite the urgent need for such a program, Congressional appropriators rejected the $125 million funding request.

The Administration hasn't relented, however, and RE-ENERGYSE is back in the new FY2011 budget request now on its way to Congress. The $74 million program would be the first small but critical step to re-energize a new generation of scientists, innovators, and entrepreneurs ready to tackle the United States' energy and competitiveness challenges (see this fact sheet for more [pdf]).

Ultimately, however, greater funding will be necessary to help the next generation of intrepid American innovators rise to the nation's clean energy challenges.

"In 1958, right after the Soviet Union launch Sputnik, the U.S. federal government authorized the National Defense Education Act, which invested billions of dollars over several years to try and regain our competitive edge in general science and engineering, and more specifically in the space race," said Teryn Norris, the moderator of the panel, adviser at the Breakthrough Institute, and director of Americans for Energy Leadership, a student-led initiative campaigning across the country for investments in clean energy education and innovation.

With American facing a new race to dominate the high-tech fields of the 21st century, the federal government will ultimately need to secure investments on the scale of the National Defense Education Act to keep the nation's competitive edge.

Dr. Kelly and Mr. Norris were joined on the panel by Dr. Lynn Orr, director of the Stanford Precourt Energy Institute and Camron Gorguinpour, director of Scientists and Engineers for America. You can watch a video of the panel here.

Originally posted at the Breakthrough Institute Read more!

Tuesday, February 16, 2010

Penny Wise and Pound Foolish: Why Obama's Symbolic Spending Freeze May Grow the Deficit

With rising anxiety about mounting federal deficits, President Obama declared a freeze on all non-defense discretionary spending in his latest budget proposal. Heavy on symbolism and light on impact, the Administration's proposal attacks all of the areas of the government least responsible for the inexorable increase in federal deficits, while potentially starving key parts of the discretionary budget critical to America's economic prosperity.

Let's be clear: ballooning deficits do pose a real long-term threat to the United States' economic security. Under current forecasts, the accumulated deficit could total $20 trillion by 2020. That could hobble Uncle Sam with interest payments on the federal debt nearly as large as the projected total for all domestic discretionary spending. Efforts clearly must be taken to avoid such an unsustainable - and risky - financial future.

That said, curbing domestic spending is the wrong route to trim the deficit. The President's spending freeze applies to only a small fraction of the federal budget, while exempting both the mounting costs of two wars and the ever-rising bill for the nation's entitlement programs - Social Security, Medicare and Medicaid.

Together, defense spending and the three big entitlement programs account for roughly 60 percent of President Obama's $3.7 trillion FY2011 budget. Defense spending has soared 70 percent since 2001, in inflation-adjusted terms, reaching the highest level in post-World War II history. The Pentagon's $708 billion 2011 budget is now 23 percent higher than the peak of Regan-era Cold War military spending. At the same time, the steady rising costs of an aging population are projected to drive the price tag for entitlement programs alone to nearly half (46%) of the U.S. budget by 2020.

There is simply no route to a balanced budget without the hard work of serious entitlement reform, including efforts to control the rising costs of health care in America. Likewise, slashing domestic spending will do little to control the deficit without efforts to rein in defense spending, beginning with the responsible disengagement from the wars in Iraq and Afghanistan.

Without a growing economy, taming the deficit will prove impossible

Despite long-term deficit concerns, slashing federal spending or raising taxes in the short-term - e.g. while economic recovery is tenuous and unemployment still hovers near ten percent - would be tantamount to economic suicide. As long as the economy remains on shaky ground, real deficit-cutting efforts will effectively stay shackled; tax revenues will remain stagnant while efforts to trim spending or raise tax rates could send the economy tumbling back into recession. Thus, without a growing economy, taming the deficit will ultimately prove impossible.

As such, getting the budget back in the black has more to do with smart investments to ignite America's engines of economic growth than symbolic spending freezes. While Clinton-era deficit reduction efforts are often credited with taming the federal deficit in the 1990's, it was robust economic growth, largely driven by the long IT boom of the mid and late '90's, that did the lion's share of the work to turn deficits into the surpluses.

Along with real entitlement reform and winding down the wars, smart government investments in broad-based economic growth must therefore be the keystone of a three-part strategy to truly balance the federal budget.

Domestic spending freeze undermines critical investments in America's prosperity

That's where the pernicious potential of the new spending freeze becomes clear: the embrace of symbolic "restraint" on domestic spending could have a real impact on the Obama Administration's efforts to make critical investments in areas like infrastructure, education, and innovation, undermining precisely the efforts necessary to get America on the path to prosperity.

The IT boom that paved the way to America's return to fiscal health in the 1990's was in fact the result of precisely the kinds of federal investments that today's budgets threaten. For four decades after World War II, the federal government made enormous investments in research universities, national laboratories, communications and micro-processing technologies, and the necessary infrastructure to support the development and commercialization of information technologies that have transformed the American workplace, created entire new industries, and made the American economy the most productive in the world.

Yet even as these government investments were paying dividends and new technologies were in the process of remaking the American economy, the U.S. government was already in the process of weakening its commitment to the very innovation system that had made the IT revolution possible. In the 1980's, federal funding for education, infrastructure, and technology R&D was already on the decline, an overall trend that only continued through the Clinton and Bush years.

Thus, even as the economic boom associated with the IT revolution was eliminating deficits that at the beginning of the decade had appeared intractable, the U.S. government became complacent about precisely the kinds of public investments that catalyzed American innovation and prosperity. With the exception of bio-medical research, which saw big increases in the late 1990's and early 2000's, federal investment in America's innovation economy has stagnated over the last three decades. And without accelerated technological innovation and progress, America's prospects for real sustained economic growth are limited.

President Obama's first budget, and the stimulus passed by Congress last winter, offered some hope for a change in course. Spending on R&D, education, technology, and infrastructure was up. And to the President's credit, the proposed 2011 budget has preserved funding increases for many of these programs despite the proposed discretionary spending freeze. But if America hopes to catch the next technological wave and ride it to fiscal stability, it will have to invest much more in its innovation economy, returning to levels not seen since before 1980.

Case in point: investment needed to secure clean energy competitiveness

Energy is a case in point, although by no means an isolated one. While investing in clean energy, or any other particular sector of the economy, will not single-handedly cure America's economic ailments, new growth sectors with multi-trillion dollar potential don't grow on trees. Making investments now to catalyze competitive clean energy technologies and industries will pay big economic dividends down the line.

American policymakers would thus be foolish to ignore the economic potential of soaring global demand for clean energy in any serious strategy to get both the U.S. economy and the federal budget back on track.

Unfortunately for a cash-strapped America, in today's increasingly competitive global environment, securing market share and leading industries in the clean tech sector won't be possible on the cheap.

In his State of the Union, President Obama lamented, "There's no reason Europe or China should have the fastest trains, or the new factories that manufacture clean energy products."

On the one hand, President Obama is right; neither China nor the EU has some inherent competitive advantage in the clean tech field.

But the President is missing the very clear reason our Asian and European competitors are out-pacing the United States in clean tech: governments in Beijing, Tokyo, Seoul, and across the eurozone are all launching (or redoubling) comprehensive national clean energy strategies backed by big, long-term public investments to support each stage of the clean tech value chain.

Take China as an example, where both the Chinese central government and numerous provincial governments are together committing tens, if not hundreds of billions of dollars annually to secure competitive clean energy industries - and the jobs, tax revenues and export opportunities that go with them.

Carving out America's market share in the growing sector will similarly require both a focused national strategy and sustained public investment to support the key components of a competitive clean energy economy: robust clean energy innovation, manufacturing leadership, and strong and consistent market demand.

"I do not accept second place for the United States of America," President Obama boldly declared in his State of the Union. Yet when it comes to the race to harness clean energy growth, the United States will continue to languish in second place - or worse - as long as clean energy investment remains restrained by the Administration's spending freeze.

Real strategy to control the deficit requires long-term focus

In the end, there are no short-term, easy fixes to a problem as intractable as the soaring federal deficit. Nor will critical public investments in education, infrastructure, innovation, and competitive American industries pay huge dividends in the next budget cycle.

Rather, a real effort to put both the federal budget and the U.S. economy back on track will require an honest commitment to take up several hard tasks over the long-haul: bringing solvency to the nation's critical entitlement programs; reining in historically-high defense spending without imperiling the nation's security; and making a series of robust, sustained public investments that can put America back on the path to long-term, shared prosperity.

Jesse Jenkins is Director of Energy and Climate Policy at the Breakthrough Institute, and co-author of "Rising Tigers, Sleeping Giant," a major report on international clean tech competitiveness. Follow him on twitter @JesseJenkins

Tuesday, January 12, 2010

CBS: Road to Economic Recovery Requires Reinvestment in Innovation

Looking beyond today's immediate economic crisis, the road to long-term economic recovery requires a major reinvestment in American innovation, R&D, and education to restore the nation's crumbling economic competitiveness, according to a terrific recent CBS Evening News report.

As Justin Rattner, Chief Technology Officer with the semiconductor giant, Intel, explains, you don't save your way out of recession, you invest your way out. And now is the time to launch a new national project of reinvestment in innovation, research and development, and science, math, engineering and technology (STEM) education that can get America back on the road to shared economic prosperity.

Watch CBS News Videos Online

Labels:

economy,

innovation,

jobs,

new energy economy,

technology,

United States

Thursday, December 03, 2009

Climate Conundrum Continues in Run-up to Copenhagen

Originally a the Breakthrough Institute

Originally a the Breakthrough Institute

The United States may be stuck in the middle of a climate conundrum. A proposal to establish border tariffs to account for the carbon associated with the imported manufactured products, like steel, looks critical to securing the support of key swing Senators interested in protecting the competitive position of American manufacturing. ... Yet ... those same tariff provisions that could win passage of a U.S. climate bill are firmly opposed by China and other developing nations and could both damage Sino-American trade relations and fissure international climate negotiations.Breakthrough's Yael Borofsky wrote that back in October, and this climate conundrum continues to present perhaps the thorniest negotiating point as world leaders prepare to meet for international climate talks in Copenhagen next week. Indeed, on the eve of the global climate talks, the negotiating positions of the United States and major developing economies, including China and India, appear to remain at loggerheads.

In a letter to President Obama today, nine moderate Democratic Senators, all key swings for climate legislation or ratification of any international climate treaty, reiterated their demands that any international climate framework U.S. negotiators sign in Copenhagen must include comparable action from all major economies and allow tariffs to adjust prices on imports from any nation that does not agree to bindings agreements to reduce emissions "in specific trade- and energy-intensive economic sectors."

"Climate change is a serious and growing threat to the United States and the world," the Senators wrote. "Smart climate change policies would guard against these risks while also spurring clean energy investments that promote economic growth and create good domestic jobs."

"Importantly, however, poorly designed climate policies could also jeopardize U.S. national interest," the Senators warned, "by imposing burdens on U.S. consumers, companies and workers without solving the climate challenge."

To address these challenges, the U.S. should seek to negotiate a new international climate agreement under which, "All major economies should adopt ambitious, quantifiable, measurable, reportable and verifiable national actions" to reduce emissions of greenhouse gases.

Furthermore, U.S. climate policy, the Senators wrote, should include provisions to implement border adjustment tariffs if necessary to help shield domestic industries facing international competition from countries that have not implemented carbon reduction requirements for their industrial sectors.

Here's the key excerpt from the letter, signed by Arlen Specter of Pennsylvania, Sherrod Brown of Ohio, Carl Levin and Debbie Stabenow of Michigan, Tim Johnson of South Dakota, Kay Hagan of North Carolina, Claire McCaskill of Missouri, Amy Klobuchar of Minnesota and Mark Begich of Alaska:

"Climate and trade policies should be designed to encourage all major emitting nations to take climate action and to deter the migration of polluting activities from one nation to another. Internationally, the United States' preferred and primary strategy ... should be to negotiate effective bilateral or multilateral agreements on reducing emissions in specific trade- and energy-intensitve economic sectors. Collectively, these new agreements -- whether negotiated under the United Nations, World Trade Organization or elsewhere -- should not only ensure emissions goals are reached but they should also integrate climate objectives into the international trade system, such as through border adjustments on imports from nations that have not yet adopted sufficient emissions control measures. ... Indeed, to promote equitable and effective global action any new U.S. climate change laws should establish a national system of border adjustments, in concert with emissions allowances or rebates to trade- and energy-intesnsive sectors of the economy. Any border adjustment policies should take effect by a date certain if appropriate international agreements have not entered force.Simultaneously, two Indian newspapers reported over the weekend on a pre-Copenhagen summit in Beijing that included leaders of Brazil, South Africa, India and China, a group collectively dubbed the "BASIC" countries that includes the largest four emitters among the developing world.

The four BASIC nations reportedly agreed on a new draft of a negotiating position that sets all four nations up to collectively walk out on the Copenhagen negotiations if any of their "non-negotiable" planks are violated.

According to the Times of India, the four nations, along with Sudan as the head of the G77, a larger bloc of developing nations participating in the climate talks, agreed on a new draft negotiating position that argues that the Copenhagen framework should largely consist of an extension of the current Kyoto Protocol framework for a second commitment period running from 2012-2020. This seems to suggest that the carbon intensity targets recently announced by China and India would be voluntary goals, not binding commitments.

That runs counter to the U.S. negotiating position, which has remained adamant that the Kyoto Framework, which excluded commitments for developing nations including the big emitters amongst the BASIC countries, is not a workable framework. The United States rejected the Kyoto Protocol and has not participated in the international treaty's current commitment period set to end in 2012.

Furthermore, the BASIC nations' "non-negotiable" planks include a pledge to stand opposed to any global deal in Copenhagen that does not explicitly reject the use of carbon border tariffs or other measures to restrict trade in the context.

The Times of India reports (emphasis added):

Besides the elements of the Kyoto Protocol, there are "significant new features" in the draft proposal worked out by BASIC countries-Brazil, South Africa, India and China-at a meeting here on Saturday, Jairam Ramesh, minister of state for environment and forest said.I have to note that China, India and the other BASIC countries' position on the border adjustments and emissions related to their exports is entirely inconsistent. They have continued to simultaneously argue that they should not be responsible for the emissions associated with the products they produce for export to developed nations and that the developed nations who buy them should be responsible. That's a fair and arguable point. But at the same time, the BASIC countries vehemently object to any border adjustment tariffs which would be a clear way for importing developed nations to take responsibility for the emissions associated with their imports (e.g. by internalizing the price of pollution associated with them).

These countries have decided not to allow rich nations to make climate change an excuse to set up trade barriers or resort to trade protectionism. Rich countries should be ready to contribute funds for stopping the process of forest degradation including the one in Amazon valley in Brazil and also invest in the process of creating new forests.

The developing nations will also not accept any pressure from developed countries to establish legally binding emission targets at Copenhagen. Developing countries want to be allowed to reduce emissions voluntarily and take what they consider to be "nationally appropriate actions" he said.

Ramesh said India will under no circumstances accept the concept of a peaking year under which each country will have to indicate on what date they will reach the highest level of pollution before beginning to come down.

India will also not accept any unsupported mitigation actions without any effort by developed countries to provide funds and technology support to improve environment in developing nations.

New Delhi has also set its face against any international measurement, reporting and verification of the work done in India for environment protection.

The Indian minister said that China, Brazil and South Africa were also in agreement on these issues.

The key, of course, is that China, India, Brazil and South Africa each put their economic development first and foremost, and border tariffs equal less exports. That's simply unacceptable to them (for easy to understand reasons).

I'm not exactly sure how this issue resolves, and it seems nearly impossible to imagine a U.S. Senate ratification of a treaty, let alone passage of a climate bill, that does not address the tariffs issue. At the same time, I can scarcely imagine China, India and the BASIC countries backing down on this issue given the central role exports play in each nation's economy.

Stay tuned. I don't envy the negotiators now embarking for Copenhagen... Read more!

Friday, November 13, 2009

EVENT: Rising Tigers, Sleeping Giant: Major New Report on US vs. Asian Competitiveness in Clean Energy Technology

A new report by the Breakthrough Institute and the Information Technology and Innovation Foundation, "Rising Tigers, Sleeping Giant," is the first to thoroughly benchmark clean energy competitiveness in four nations: China, Japan, South Korea and the United States.

Developing better and cheaper clean energy technologies will be central to addressing climate change, securing U.S. energy independence, and creating new clean energy jobs. Increasingly, nations are seeking to gain competitive advantage in this rapidly growing, high-technology sector and the stakes for the United States are significant: will the United States largely be an importer of these clean technologies and lose the jobs related to them, or can America emerge as a global leader, driving exports and high-wage jobs?

The report analyzes clean energy investments and public policy support for research and innovation, manufacturing, and domestic demand, with a particular focus on six key technologies: wind, solar, nuclear, carbon capture and storage, hybrid and electric vehicles and advanced batteries, and high-speed rail.

Please join the Breakthrough Institute and ITIF for a discussion of the report's findings.

Date: Wednesday, November 18, 2009

Time: 10:30 AM - 11:30 AM

Location: Washington, D.C. - Senate Energy Committee Room, Dirksen Senate Office Building (SD-366)

Moderator and Presenter

Robert Atkinson (bio)

President, The Information Technology and Innovation Foundation

Guests

Congressman Rush Holt (D-NJ, bio)

Congressman Ron Klein (D-FL, bio)

Presenters

Jesse Jenkins (bio)

Director of Energy and Climate Policy, The Breakthrough Institute

Michael Shellenberger (bio)

President, The Breakthrough Institute

Gary Fazzino, Vice President of Government Affairs, Applied Materials (Invited) Read more!

Friday, October 23, 2009

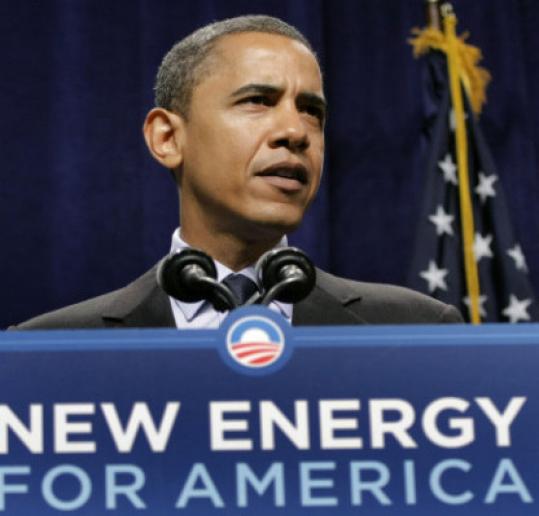

SPEECH: Obama Challenges Americans to Lead in Clean Energy Technology

Quick post with the text of President Obama's speech today at MIT, challenging Americans to lead the global economy in clean energy technology.

Quick post with the text of President Obama's speech today at MIT, challenging Americans to lead the global economy in clean energy technology.

Once again dead-on rhetoric from Obama, but absolutely no indication that there's a real commitment to the kind of policies that will give the U.S. an edge in the global clean energy race. With China, Japan, South Korea, the EU and many more racing ahead with real policy support for clean energy technology development and demonstration, manufacturing, and direct and targeted incentives for the deployment of a suite of emerging technologies, the economic stakes are high and time is short.

America elected Obama to deliver on his rhetoric. Not to deliver more rhetoric. The Senate is crafting the bill that could win or lose the global clean energy race right now. That bill will either turn Obama’s rhetoric into reality, or prove it nothing much more than inspirational speaking. What’s it going to be?

Here's the text of President Obama's remarks (I've cut out all the introductory remarks and thank yous and yatta yattas...)

REMARKS BY THE PRESIDENT CHALLENGING AMERICANS TO LEAD THE GLOBAL ECONOMY IN CLEAN ENERGY

Massachusetts Institute of Technology

Boston, Massachusetts

12:44 P.M. EDT

THE PRESIDENT: Thank you very much. Please, have a seat. Thank you. Thank you, MIT. ...

[SNIP]

Now, Dr. Moniz is also the Director of MIT's Energy Initiative, called MITEI. And he and President Hockfield just showed me some of the extraordinary energy research being conducted at this institute: windows that generate electricity by directing light to solar cells; light-weight, high-power batteries that aren't built, but are grown -- that was neat stuff; engineering viruses to create -- to create batteries; more efficient lighting systems that rely on nanotechnology; innovative engineering that will make it possible for offshore wind power plants to deliver electricity even when the air is still.

And it's a reminder that all of you are heirs to a legacy of innovation -- not just here but across America -- that has improved our health and our wellbeing and helped us achieve unparalleled prosperity. I was telling John and Deval on the ride over here, you just get excited being here and seeing these extraordinary young people and the extraordinary leadership of Professor Hockfield because it taps into something essential about America -- it's the legacy of daring men and women who put their talents and their efforts into the pursuit of discovery. And it's the legacy of a nation that supported those intrepid few willing to take risks on an idea that might fail -- but might also change the world.

Even in the darkest of times this nation has seen, it has always sought a brighter horizon. Think about it. In the middle of the Civil War, President Lincoln designated a system of land grant colleges, including MIT, which helped open the doors of higher education to millions of people. A year -- a full year before the end of World War II, President Roosevelt signed the GI Bill which helped unleash a wave of strong and broadly shared economic growth. And after the Soviet launch of Sputnik, the first artificial satellite to orbit the Earth, the United States went about winning the Space Race by investing in science and technology, leading not only to small steps on the moon but also to tremendous economic benefits here on Earth.

So the truth is, we have always been about innovation, we have always been about discovery. That's in our DNA. The truth is we also face more complex challenges than generations past. A medical system that holds the promise of unlocking new cures is attached to a health care system that has the potential to bankrupt families and businesses and our government. A global marketplace that links the trader on Wall Street to the homeowner on Main Street to the factory worker in China -- an economy in which we all share opportunity is also an economy in which we all share crisis. We face threats to our security that seek -- there are threats to our security that are based on those who would seek to exploit the very interconnectedness and openness that's so essential to our prosperity. The system of energy that powers our economy also undermines our security and endangers our planet.

Now, while the challenges today are different, we have to draw on the same spirit of innovation that's always been central to our success. And that's especially true when it comes to energy. There may be plenty of room for debate as to how we transition from fossil fuels to renewable fuels -- we all understand there's no silver bullet to do it. There's going to be a lot of debate about how we move from an economy that's importing oil to one that's exporting clean energy technology; how we harness the innovative potential on display here at MIT to create millions of new jobs; and how we will lead the world to prevent the worst consequences of climate change. There are going to be all sorts of debates, both in the laboratory and on Capitol Hill. But there's no question that we must do all these things.

Countries on every corner of this Earth now recognize that energy supplies are growing scarcer, energy demands are growing larger, and rising energy use imperils the planet we will leave to future generations. And that's why the world is now engaged in a peaceful competition to determine the technologies that will power the 21st century. From China to India, from Japan to Germany, nations everywhere are racing to develop new ways to producing and use energy. The nation that wins this competition will be the nation that leads the global economy. I am convinced of that. And I want America to be that nation. It's that simple. (Applause.)

That's why the Recovery Act that we passed back in January makes the largest investment in clean energy in history, not just to help end this recession, but to lay a new foundation for lasting prosperity. The Recovery Act includes $80 billion to put tens of thousands of Americans to work developing new battery technologies for hybrid vehicles; modernizing the electric grid; making our homes and businesses more energy efficient; doubling our capacity to generate renewable electricity. These are creating private-sector jobs weatherizing homes; manufacturing cars and trucks; upgrading to smart electric meters; installing solar panels; assembling wind turbines; building new facilities and factories and laboratories all across America. And, by the way, helping to finance extraordinary research.

In fact, in just a few weeks, right here in Boston, workers will break ground on a new Wind Technology Testing Center, a project made possible through a $25 million Recovery Act investment as well as through the support of Massachusetts and its partners. And I want everybody to understand -- Governor Patrick's leadership and vision made this happen. He was bragging about Massachusetts on the way over here -- I told him, you don't have to be a booster, I already love the state. (Applause.) But he helped make this happen.

Hundreds of people will be put to work building this new testing facility, but the benefits will extend far beyond these jobs. For the first time, researchers in the United States will be able to test the world's newest and largest wind turbine blades -- blades roughly the length of a football field -- and that in turn will make it possible for American businesses to develop more efficient and effective turbines, and to lead a market estimated at more than $2 trillion over the next two decades.

This grant follows other Recovery Act investments right here in Massachusetts that will help create clean energy jobs in this commonwealth and across the country. And this only builds on the work of your governor, who has endeavored to make Massachusetts a clean energy leader -- from increasing the supply of renewable electricity, to quadrupling solar capacity, to tripling the commonwealth's investment in energy efficiency, all of which helps to draw new jobs and new industries. (Applause.) That's worth applause.

Now, even as we're investing in technologies that exist today, we're also investing in the science that will produce the technologies of tomorrow. The Recovery Act provides the largest single boost in scientific research in history. Let me repeat that: The Recovery Act, the stimulus bill represents the largest single boost in scientific research in history. (Applause.) An increase -- that's an increase in funding that's already making a difference right here on this campus. And my budget also makes the research and experimentation tax credit permanent -- a tax credit that spurs innovation and jobs, adding $2 to the economy for every dollar that it costs.

And all of this must culminate in the passage of comprehensive legislation that will finally make renewable energy the profitable kind of energy in America. John Kerry is working on this legislation right now, and he's doing a terrific job reaching out across the other side of the aisle because this should not be a partisan issue. Everybody in America should have a stake -- (applause) -- everybody in America should have a stake in legislation that can transform our energy system into one that's far more efficient, far cleaner, and provide energy independence for America -- making the best use of resources we have in abundance, everything from figuring out how to use the fossil fuels that inevitably we are going to be using for several decades, things like coal and oil and natural gas; figuring out how we use those as cleanly and efficiently as possible; creating safe nuclear power; sustainable -- sustainably grown biofuels; and then the energy that we can harness from wind and the waves and the sun. It is a transformation that will be made as swiftly and as carefully as possible, to ensure that we are doing what it takes to grow this economy in the short, medium, and long term. And I do believe that a consensus is growing to achieve exactly that.

The Pentagon has declared our dependence on fossil fuels a security threat. Veterans from Iraq and Afghanistan are traveling the country as part of Operation Free, campaigning to end our dependence on oil -- (applause) -- we have a few of these folks here today, right there. (Applause.) The young people of this country -- that I've met all across America -- they understand that this is the challenge of their generation.

Leaders in the business community are standing with leaders in the environmental community to protect the economy and the planet we leave for our children. The House of Representatives has already passed historic legislation, due in large part to the efforts of Massachusetts' own Ed Markey, he deserves a big round of applause. (Applause.) We're now seeing prominent Republicans like Senator Lindsey Graham joining forces with long-time leaders John Kerry on this issue, to swiftly pass a bill through the Senate as well. In fact, the Energy Committee, thanks to the work of its Chair, Senator Jeff Bingaman, has already passed key provisions of comprehensive legislation.

So we are seeing a convergence. The naysayers, the folks who would pretend that this is not an issue, they are being marginalized. But I think it's important to understand that the closer we get, the harder the opposition will fight and the more we'll hear from those whose interest or ideology run counter to the much needed action that we're engaged in. There are those who will suggest that moving toward clean energy will destroy our economy -- when it's the system we currently have that endangers our prosperity and prevents us from creating millions of new jobs. There are going to be those who cynically claim -- make cynical claims that contradict the overwhelming scientific evidence when it comes to climate change, claims whose only purpose is to defeat or delay the change that we know is necessary.

So we're going to have to work on those folks. But understand there's also another myth that we have to dispel, and this one is far more dangerous because we're all somewhat complicit in it. It's far more dangerous than any attack made by those who wish to stand in the way progress -- and that's the idea that there is nothing or little that we can do. It's pessimism. It's the pessimistic notion that our politics are too broken and our people too unwilling to make hard choices for us to actually deal with this energy issue that we're facing. And implicit in this argument is the sense that somehow we've lost something important -- that fighting American spirit, that willingness to tackle hard challenges, that determination to see those challenges to the end, that we can solve problems, that we can act collectively, that somehow that is something of the past.

I reject that argument. I reject it because of what I've seen here at MIT. Because of what I have seen across America. Because of what we know we are capable of achieving when called upon to achieve it. This is the nation that harnessed electricity and the energy contained in the atom, that developed the steamboat and the modern solar cell. This is the nation that pushed westward and looked skyward. We have always sought out new frontiers and this generation is no different.